Part 2 of this true story [1] brought a new wave of challenges as the health of the owner’s spouse began to decline, creating an overwhelming emotional burden. Despite the impressive increase of the company’s value from $2 million in 2019 to $6 million in 2024, the owner chose the path of least resistance to ensure an immediate succession plan, prioritizing personal circumstances over potential financial gain.

This is a story about a situation that was a little too late. The owner ultimately prioritized their well-being and left millions of dollars on the table.

Initial Challenges

-The business heir-apparent had difficulty securing financing and lacked leadership skills to run a healthy business.

-The owner was too exhausted to look for potential buyers.

-Emotions affected clear judgment.

-The financials and sales scenarios were not properly documented, which hindered effective decision-making.

The Transformation Journey

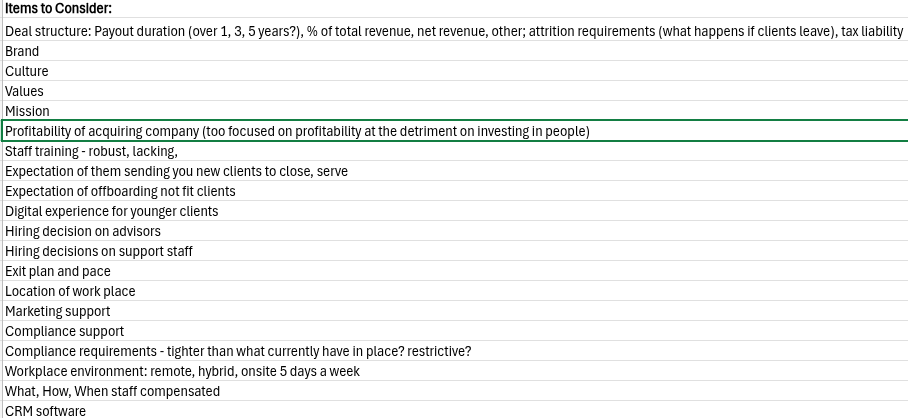

Developed and documented sales scenarios to manage emotional aspects and enable clear decision-making: We outlined various sales scenarios in a visual flow chart. This exercise allowed the involved parties to better understand implications and make informed, rational decisions.

Documented the buyer selection process and minimize the burden on the owner: We documented key items and requirements to form a checklist for the owner to fill out when vetting each buyer. This exercise expedited the selection process and reduced the time and stress.

Developed a backup plan if the heir apparent decided to leave: We created a contingency plan to provide the business with stability and peace of mind while mitigating risks associated with the heir apparent potentially leaving the company prior to sale.

Outlined a transition communication plan to inform clients: We documented a well-structured communication plan that ensured clients were kept informed about the upcoming ownership change. The plan’s goal was to maintain trust, foster positive relationships, and retain all clients during the transition.

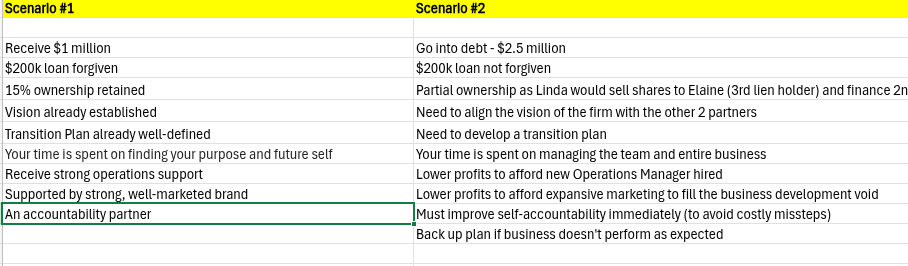

Calculated detailed split-sale scenarios based on sales options and agreement commitments, addressing financing obstacles for the potential successor: We documented a basic financial breakdown for each sales scenario to remove emotions and allow the owner to make better-informed decisions regarding potential financing obstacles.

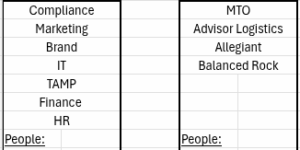

Documented which people and providers would transition with the owner vs. the buyer: We identified key personnel and service providers that would be hired and/or remain with each sale scenario. This plan allowed for a well-organized and smooth handover of operations, minimizing disruptions and ensuring business continuity.

Selling with no Regrets

Despite our dedicated efforts to prepare the business for the highest possible sale price and make decisions with an unbiased perspective, the founder couldn’t handle courting buyers. The heir apparent secured financing from a third-party institution for half of the company’s open market value. Although this decision wasn’t the most financially advantageous, it left the owner feeling confident that they had looked at all scenarios and made sure the buyer would benefit financially. Ultimately, the choice was seen as the best path for both the company and its leader, allowing them both to begin a new chapter.

Takeaways

This true story is a valuable lesson for business owners and stakeholders. The company faced challenges during its transformation but saw its value grow significantly. This growth happened because it made strategic changes, streamlined operations, expanded its scale, and effectively used skilled talent.

However, it’s important to remember that business decisions are not solely driven by financial gain. Emotional and personal factors play into choices and in this case the owner chose to prioritize their well-being and opt for a path of least resistance.

This story highlights the risks of not taking action [2] and the need for a clear succession plan. It is important to balance work and personal priorities, and to consider how outside support can help businesses during times of change. While this is not the outcome we wanted, sharing this experience can help you think about all the factors that affect ownership transitions.

Will You Be Next?

At My Virtual COO, we help service-based Health, Wealth, and Advocacy business owners optimize talent and systems to accelerate business success by improving the most important parts of the business, including:

- *Growth, Profitability, and Impact Projections

*Organizational Design

*Lean Process Design

*Client Experience Documentation

*Productive Collaboration and Change Acceleration

*C-Suite Training

Ready for your own success story? We would love to speak with you [3].