Chances are if you’ve spent time being an advisor, the landscape looks much different today than it did the first day you started in the industry. You may wonder if independent RIA firms will be able to survive among the larger custodian’s retail branches, the Vanguard’s, and the large RIA firms like Carson, Goldman Sachs, Mariner, and more.

Despite all the evolution, small firms don’t appear to be suffering. The Internet afforded small, niche firms a platform that allows them to be just as profitable in per-partner take-home pay as advisors in billion dollar firms (Kitces).

So what’s the catch? If mega-firms continue to grow while small, niche firms are also thriving, where is the disconnect? Who isn’t coming out on top?

The Backdrop

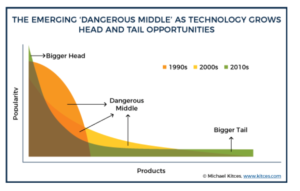

In his article, The Long Tail, The Big Head, and the Dangerous Middle of Financial Advisory Firms, financial writer Michael Kitces applies Chris Anderson’s “long tail” phenomenon to the financial advisory business. As Anderson explains in The Long Tail, the emergence of the Internet created a trend from traditional brick-and-mortar, hard inventory-based businesses to online businesses.

As major businesses grew to a “head,” they simultaneously created smaller businesses in “the tail” to leverage the online marketplace for niche markets. These smaller, online businesses became successful and over time, both the head and tail have continued to grow and put pressure on “the dangerous middle.”

The advisory business is no exception. Big firms continue to grow, but so do solo, niche firms. Advisors at mega-firms are taking home just as much pay at the end of the day as solo, niche advisors. However, those in the dangerous middle, $150 million to $2 billion AUM, are not winning, yet.

Change the Outcome

Scores of brilliant advisors have the knowledge, entrepreneurial drive, and gumption to build a firm to this mid-range size on their own or with a handful of partners. In fact, many of these firms have experienced decades of steady growth… until pressures from both above and below, the head and the tail, started pulling from their prospect base.

So how does a firm get stuck in this damaging zone? Somewhere along the way, the old way of doing things stopped working. Staff and skills sets needed to shift, an influx of not-ideal business distracted the firm from its mission, or the firm struggled with profitability from the start but the numbers were smaller and less obvious.

The reasons for stagnation are many and varied, but these three business errors are the common denominator among the majority:

- The Hat-Rack Advisor: The hat-rack advisor is the one who tries to wear all the firm’s hats at once, taking on all types of assorted tasks that suck up capacity, increase stress, and drain energy. This advisor acts as the CEO, the manager of staff, the CIO, the COO, the staff mentor, and more. This advisor is constantly juggling roles and tasks that could be easily delegated to a staff member or outsourced to a professional service provider.

- The Open-Door Policy: Some firms will service anyone who walks in the door, regardless if they fit the ideal client profile or not. Not only does this make it hard to define your niche and teach the community about the types of clients you serve (to get those quality referrals), but complicates marketing efforts, onboarding processes, management processes, and everything in between.

- Management Avoidance: As roles and responsibilities shift around a growing client base, business needs, and industry trends, the manager subconsciously avoids revisiting staff and processes.

Getting out of the middle is tough. A firm must either decide to scale up or down, grow or pivot to a niche market. Both options require tough decisions and checking the pride and ego at the door. The options also require an open mindset to change and a desire to transform.

The good news is that there are a rising number of firms who are successfully rising out of the dangerous middle phase. They embrace considerable mindset changes and reorganize the business and public brand. These rising firms set a course of action, move forward in fits and starts, embrace wins experienced along the way, and celebrate their bravery at taking the “road less traveled”. The beauty of rising out of the middle is it creates positive energy, clarity, and culture improvements that naturally seep into their community, homes, and client base. This “seep” creates more raving fans, referrals, and natural organic growth with less effort and it is a beautiful thing to witness.

I am thankful to work with amazing firms that are willing to tackle this climb out of the dangerous middle. They are worried and yet, brave. They are fearful of change, and yet embrace it at the pace they can withstand. They are passionate about helping consumers navigate a goal of financial freedom. This means putting the health of the business before themselves and enduring the temporary discomfort that comes with reorganizing their business, mindset, and people. The path to growth, profitability, and building a business for generational success is the road less taken.

Sincerely,

PS. Want to talk more about how I help businesses make progress and operate better? Click HERE. Want to receive my monthly solutions email? Click HERE.