Every entrepreneur dreams big. Whether it’s expanding operations, growing revenue, or building a powerful brand.

The difficult task for business owners is deciding how to get there and what it will cost to do so. The greatest strategies in the world mean nothing if they cost too much to implement.

That’s where a business plan profit and loss projection becomes essential. It helps you build a realistic path toward your goals, anchored in data, logic, and practical execution. No more guessing. Just smart, actionable planning.

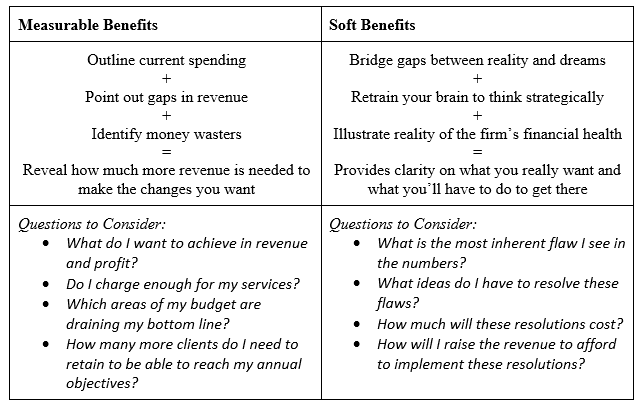

Why a Business Plan Profit and Loss Projection Is Crucial

The benefits of creating your projection are measurable and soft. However, don’t let the word “soft” fool you. These benefits are just as important as measurable numbers don’t tell the whole story. And the answers to the questions will provide priceless clarity.

This tool isn’t just for large corporations or startups pitching investors. Every small business, freelancer, or local shop owner can benefit from this clear financial forecast. And if you’re working on a formal business plan, this projection is one of the most critical sections.

How to Build Business Plan Profit and Loss Projection

Let’s walk through the actual steps to create this projection.

Step 1: Gather Your Historical Data

Start by pulling last year’s profit and loss report from your accounting software—QuickBooks, Xero, or whatever platform you use. Make sure it’s monthly, not annual.

Why monthly? Monthly data reveals important patterns:

- Seasonal trends (e.g., higher sales in Q4).

- When major expenses hit.

- Timing gaps between income and costs.

Export the report into Excel or Google Sheets and get ready to build.

Step 2: Structure Your Spreadsheet

Design a clear layout with columns for each month and rows for major categories. Include the following:

- Revenue (by product/service lines)

- Cost of Goods Sold (COGS)

- Gross Profit (Revenue – COGS)

- Operating Expenses (e.g., salaries, rent, marketing)

- EBITDA

- Taxes

- Net Profit

Add formulas to automate calculations like gross and net profit. This not only ensures accuracy but also makes it easier to update regularly.

Step 3: Forecast Revenue

Now, estimate how much money your business will bring in next year.

Look at historical trends. Did you grow 10% year over year? What changed?

Factor in new revenue sources too—new clients, markets, or product lines. Include the start month for each. Be realistic but optimistic.

For example:

If you’re launching a new service in March expected to earn $4,000/month, only include that revenue starting in March.

Be Realistic: Investors can spot overly ambitious projections. Use conservative estimates to remain credible.

Step 4: Forecast Expenses

Separate your costs into fixed and variable:

- Fixed Costs: Salaries, rent, software subscriptions.

- Variable Costs: Shipping, commissions, raw materials.

Add in upcoming investments—new hires, events, rebrands, or advertising—and show when those costs start. For example, if you’re hiring in April, the cost shows up starting in April.

This monthly structure gives you visibility and lets you adjust easily.

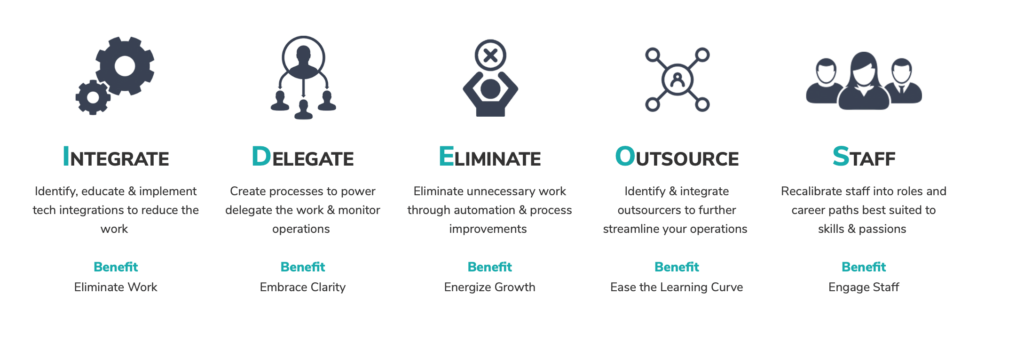

Use the IDEOS™ Framework to Prioritize Intelligently

Once your numbers are on paper, you may realize: “I can’t afford everything at once.” That’s okay. The IDEOS™ framework helps you make trade-offs that support your business strategy:

Every new cost or investment in your business plan profit and loss projection should fit into one of these solutions. If it doesn’t? Rethink it.

Example: Attending a $5,000 industry event might seem useful but if it doesn’t support revenue growth or efficiency, redirect that money to a hire or lead generation campaign.

Test Scenarios and Adjust Accordingly

No projection is perfect. But with a few scenarios, you can prepare for the unexpected.

- Base Case: Most likely outcome.

- Best Case: If everything goes right—higher revenue, lower costs.

- Worst Case: A dip in sales, delayed hiring, higher expenses.

By running these simulations, you’ll see where your business can stretch—and where you need safety nets.

Recommended Tools for Profit and Loss Projections

You don’t need to start from scratch. Here are some tools to make building your business plan profit and loss projection easier:

- Google Sheets or Excel – Fully customizable, ideal for hands-on business owners.

- QuickBooks or Xero Budgeting –Syncs with your financials to auto-generate forecasts.

- LivePlan –Great for startups needing visuals and investor-ready reports.

- PlanGuru – Best for advanced financial modeling and “what-if” analysis.

Use what feels natural. The key is consistency and clarity.

Common Mistakes to Avoid

- Guessing Revenue: Avoid rounding up numbers. Tie every estimate to historical or market data.

- Ignoring Seasonality: If Q4 is your busiest time, don’t spread revenue evenly across months.

- Forgetting One-Time Costs: Launches, legal fees, or renovations include them in your timeline.

- Not Updating the Projection: Update it monthly or quarterly based on real data.

Conclusion: Why This Projection Deserves Your Attention

A business plan profit and loss projection isn’t just a spreadsheet exercise. It’s a strategy tool. It helps you align big dreams with financial realism. It gives you the confidence to say “yes” to opportunities—and “no” to distractions.

Done right, it brings focus, clarity, and accountability to your business plan. You’ll understand the trade-offs, timing, and impact of each decision

So take the time to build yours. Not just for the bank or an investor—but for you. Because clarity isn’t just good business—it’s smart leadership.

Frequently Asked Questions

How often should I update my business plan profit and loss projection?

At least quarterly—monthly is even better. Keep your numbers fresh and aligned with reality.

What’s the difference between a profit and loss projection and a cash flow forecast?

Your P&L projection shows income and expenses. A cash flow forecast shows when cash enters and leaves. Both are important, but they serve different purposes.

Do I need to include taxes and interest?

Yes. Even if they’re estimates, they help paint a complete financial picture.

Is this only for startups?

Not at all. Every business new or established needs a clear view of future performance.

At My Virtual COO, we help service-based health, wealth, and advocacy business owners optimize talent and systems to accelerate business success by improving the most important parts of the business, including:

- Growth, Profitability, and Impact Projections

- Organizational Design

- Lean Process Design

- Client Experience Documentation

- Productive Collaboration and Change Acceleration

- C-Suite Training